08 December 2023

An economic overview of the Irish pig sector for 2023 & outlook for 2024

The Teagasc Outlook 2024 conference took place recently, economic overviews and outlooks for various agricultural sectors were presented by a number of leading Teagasc experts, with Michael McKeon, Specialised Pig Adviser, representing the pig sector, reviewing 2023 and forecasting 2024.

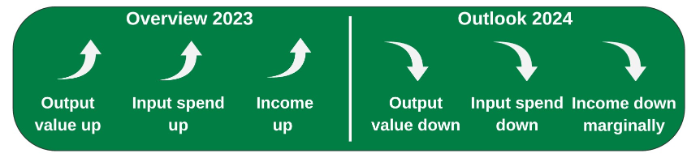

Economic overview of 2023

- Composite feed price per tonne entered 2023 on a historic high level (€480/tonne) arising from the feed ingredient prices increasing rapidly with the outbreak of the Ukrainian war.

- The 2023 annual average feed cost is estimated to be 155 cent per kg dwt. This is virtually unchanged from the 2022 (156 cent) but higher than the 5 year average (129 cent).

- At 224 cent per kg, the 2023 Irish pig price was significantly higher than the 2022 average (182 cent per kg), primarily attributable to the input cost inflation following the outbreak of the Ukrainian war and a tightening of EU pig supply.

- The estimated 2023 average pig price of 224 cent per kg is significantly higher than the five year average (2019-2023) of 181 cent per kg.

- The 2023 ‘Margin Over Feed’ (MOF) per kg is estimated to be 69 cent per kg dwt. This is significantly higher (+46%) then the 26 cent in 2022, which was the lowest in 40 years.

- The volume of Irish pigs slaughtered decreased to 3.48m in 2023, which was a decrease of 360,000 pigs (-9.3%) on the 2022 level and similar to the 2014 level. In 2023, of the 3.84m pigs of ROI origin that were slaughtered, 0.353m were slaughtered in Northern Ireland, a decline of 41,000 pigs on the 2022 level.

- In 2023, pig slaughter volumes in the main European pig producing countries decreased by 8% compared to 2022. The countries with the largest decrease were Denmark (-19%) Germany (-6%), Spain (-6%), France (-5%).

- The 2023 exports (Jan-Sept.) of Irish pigmeat declined by 17% when compared to 2022. The largest destination decline was China which decreased in export volume by 7%. The EU pigmeat exports to China also declined in volume terms in 2023 when compared to 2022 (690,000 versus 788,000 tonnes)

Economic outlook for 2024

- The November 2023 composite pig feed price of €399 per tonne will be maintained into early 2024.

- In Q2 and Q3 of 2024, pig feed costs are forecast to marginally decrease, with expectations of good harvest yields in the northern hemisphere and further transition to contract milling / forward buying.

- Forecasts for the 2024 South American (SA) soyabean harvest suggest it will reach 163 mt. however current drought conditions in some parts of Brazil may lead to a lower forecast.

- The annualised composite pig feed price is forecast to decrease by 10 percent in 2024 relative to 2023. This represents a decrease to 139 cent per kg in 2024 when compared to 155 cent per kg in 2023.

- In 2023 the size of the EU sow herd is likely to continue to stabilise in the main pig producing countries, with the exception of Spain. The Spanish sow herd is expected to continue its long term growth, albeit at a lower level then previously (+1%).

- In 2024, the size of the Irish sow herd is expected to stabilise / marginally increase after a significant reduction in 2022-2023, but the tight supply volume of Irish pigs is expected to continue.

- The volume of exports of pigmeat from the EU to China will have an important influence on the EU & Irish pig price in 2024. It is expected that China’s import requirements from the EU will remain weak due to their continued sow herd culling.

- African Swine Fever (ASF) will continue to feature in 2024 with further cases in Eastern Europe and western Europe countries continuing heightened biosecurity pre-cautions.

- In 2024, the Irish pig price is forecast to be 200 cent per kg, but this forecast is highly influenced by ASF developments, EU pig supply volumes and Chinese import demand.

- Following high losses in 2021-2022 and a return to profitability in 2023, the Irish pig sector is expected to continue to deliver moderate levels of profitability in 2024.